Overview

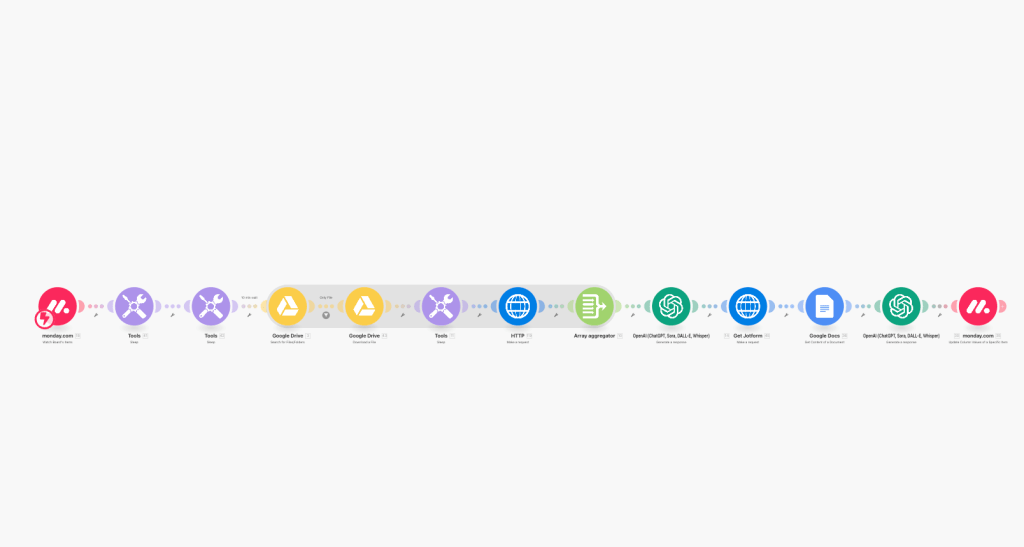

A lending operations team needed a faster, more reliable way to review customer bank statements as part of their loan origination process. Instead of manually reading multi-page OCR exports and rebuilding summaries in spreadsheets, we implemented an OpenAI-powered financial auditor that ingests raw OCR text from bank statements stored in Google Drive and produces a clean, consolidated monthly summary.

This case study outlines how we orchestrated the workflow with Monday.com, Jotform, Google Drive, and OpenAI to turn messy statement text into decision-ready financial insights.

Goal / Objective

- Automate the review of bank statements as part of a loan origination (LOS) workflow.

- Transform unstructured OCR text from bank statements into structured, analyzable data.

- Identify distinct monthly statement periods across multiple pages and accounts.

- Extract key financial figures from each statement’s Summary section.

- Produce a consolidated report that underwriters and financial analysts can use immediately.

Challenge / Problem

Traditional bank statement review in lending workflows has several pain points:

- Unstructured OCR text: Bank statements are often scanned and converted to text with inconsistent formatting, line breaks, and artifacts.

- Multiple pages and periods: A single upload may contain several months of statements, sometimes across different accounts or banks.

- Manual consolidation: Analysts must scroll through pages of text, locate each “Summary” section, and manually copy figures into spreadsheets.

- Risk of human error: Misreading a number or missing a month can materially impact underwriting decisions.

The client needed a way to reliably interpret this raw OCR text and surface the most important financial figures with minimal human effort.

The Workflow / Solution

We designed an AI-assisted workflow that uses Monday.com as the orchestration layer, Google Drive as the document store, and OpenAI as the analysis engine.

1. Intake and Task Creation

- Bank statements are uploaded and stored in Google Drive.

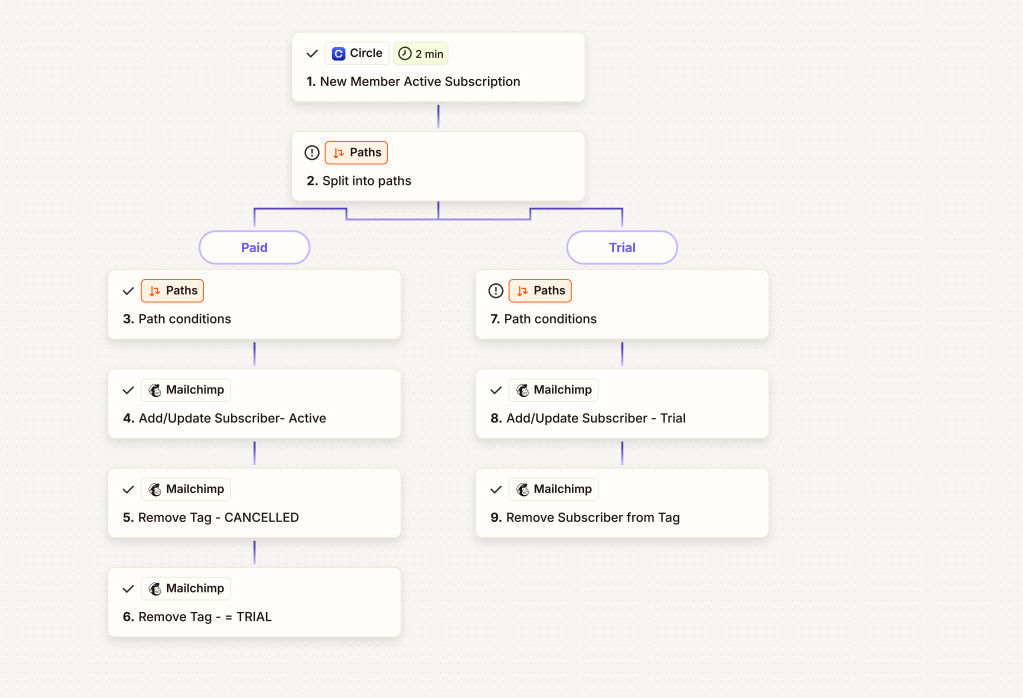

- A new item is created in the Portfolio / LOS workflow (either directly in Monday.com or via a Jotform intake form feeding into Monday).

- The task includes links to the relevant Google Drive files and the raw OCR text output from the statement processing step.

2. Triggering the Financial Audit

- When a new “Financial Audit” task is created or moved into the audit stage in Monday.com, an automation kicks off.

- The automation collects the unstructured OCR text for all uploaded bank statement pages associated with that task.

- The text payload is sent to an OpenAI financial auditor prompt tuned specifically for bank statement analysis.

3. AI Analysis of Bank Statements

The OpenAI workflow is instructed to:

- Identify distinct statement periods

- Detect start and end dates for each monthly statement.

- Group pages belonging to the same month or statement period.

- Locate each “Summary” section

- Scan the OCR text for sections labeled “Summary”, “Account Summary”, or similar variants.

- Isolate the lines inside those sections even when formatting is inconsistent.

- Extract key financial figures (when present), such as:

- Opening balance

- Closing balance

- Total deposits / credits

- Total withdrawals / debits

- Fees assessed

- Average balance or minimum balance

- Normalize and validate values

- Standardize currency formats and negative/positive signs.

- Cross-check that opening/closing balances align with total debits and credits when possible.

- Generate a consolidated report

- Output a structured, human-readable summary for each month.

- Provide a consolidated view across all months included in the upload.

4. Consolidated Output Back to the LOS

- The AI’s structured output is returned in a predictable JSON-like structure and formatted into a clear, readable report.

- This report is attached back to the task (in Monday.com and/or ClickUp) as:

- A formatted summary section in the task, and/or

- A linked document that underwriters can reference.

- Optional flags or notes are added for:

- Missing or inconsistent months.

- Large swings in balances or unusual transaction patterns.

- Any parsing ambiguities that may require human review.

Results / Impact

While this implementation is primarily focused on workflow and data quality rather than marketing metrics, the solution is designed to deliver:

- Dramatically reduced manual review time: Analysts receive a ready-made monthly breakdown instead of scrolling through raw OCR pages.

- Higher consistency and fewer errors: The same extraction logic is applied every time, reducing the chance of missed months or mis-keyed values.

- Faster underwriting decisions: With clean monthly summaries, lending or risk teams can focus on judgment calls rather than transcription.

- Scalability: The pipeline can handle many concurrent statement reviews without requiring additional headcount.

Tools Used

- Monday.com – Orchestrates the LOS workflow, tracks each audit request, and stores AI outputs alongside tasks.

- Jotform – (Optional) Used to collect client inputs or upload instructions that feed into Monday.com.

- Google Drive – Secure storage for uploaded bank statement files and OCR outputs.

- OpenAI – Core financial auditor engine that interprets OCR text, extracts figures, and builds the consolidated report.

- Make.com – Automates integrations and workflows between tools, enhancing process efficiency.

Leave a comment