Client Goal:

Simplify the onboarding process for new tax clients by automatically sending relevant tax documentation based on their appointment type in Calendly.

🛠️ The Challenge

Tax professionals often spend time manually identifying a client’s needs after an appointment is booked — then preparing and emailing the appropriate forms. This process was error-prone, slow, and inconsistent.

⚙️ The Automated Workflow

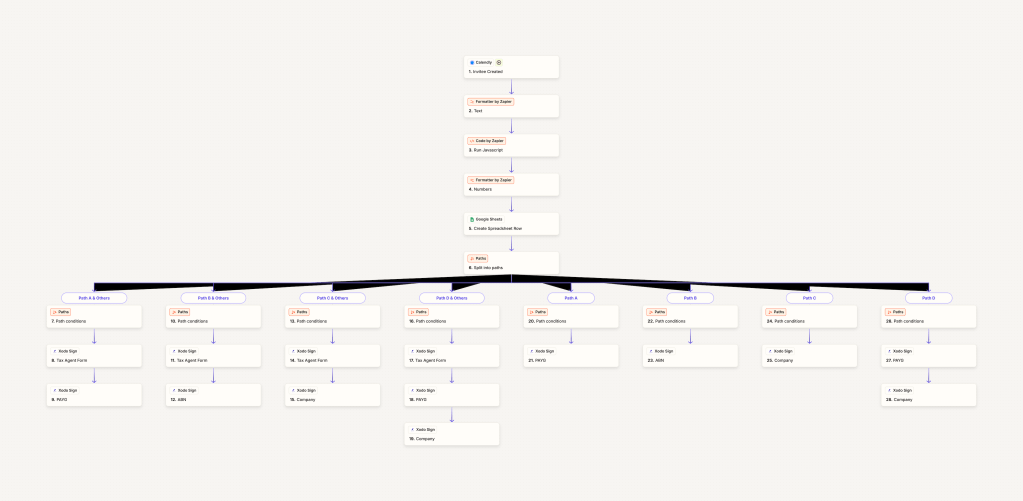

Using Zapier, we created an end-to-end automation that:

- Triggers on Calendly Invite Creation

- Uses Formatter and JavaScript by Zapier to parse appointment metadata.

- Sorts clients by tax category (PAYG, ABN, Company, or Tax Agent-only) using conditional Paths.

- Creates a row in Google Sheets for internal tracking and reporting.

- Delivers required documents via Xodo Sign, fully tailored to the client’s appointment type.

🔄 Document Logic Snapshot

Each conditional path uses custom logic to decide:

- If the client is PAYG, ABN, or a Company.

- If multiple documents are required (e.g., Tax Agent Form + Company Agreement).

- Which Xodo Sign documents to send in what order.

Example Path:

- Calendly Appointment ➝ PAYG Path ➝ Tax Agent Form + PAYG Form sent via Xodo Sign.

💡 Results & ROI

- Time Saved: Reduced manual email prep by ~10 minutes per client.

- Consistency: 100% correct document delivery rate based on appointment logic.

- Professionalism: Seamless, branded document experience via Xodo Sign.

- Scalability: New tax form types or appointment types can be added easily via Zapier Paths.

📌 Tools Used

- Zapier (Multi-Path Zaps)

- Calendly

- Xodo Sign

- Google Sheets

- JavaScript Formatter by Zapier

✅ Outcome

The client now enjoys a hands-free onboarding process, with smart routing of documents tailored to each client’s appointment type — improving operational efficiency and enhancing the customer experience.

Leave a comment