Client Goal:

After clients complete their tax documents via Xodo Sign, send them a customized welcome email and checklist based on their tax category as well as collect payment — without lifting a finger.

🧩 The Problem

Once clients signed their documents, the business had to manually:

- Review the submission,

- Categorize the client (PAYG, ABN, or Tax Agent only),

- Send follow-up emails and onboarding resources.

This added hours of admin time each week and left room for error.

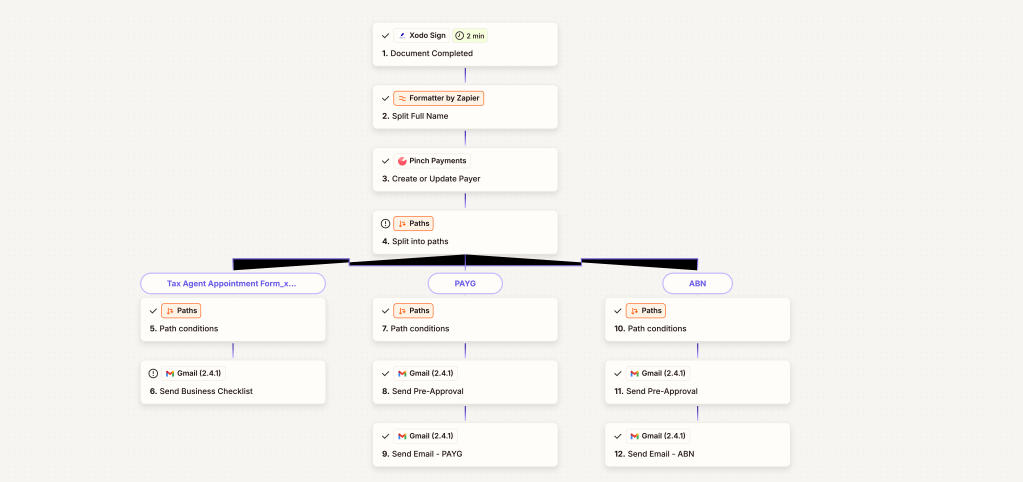

⚙️ The Automated Workflow

Once a document is signed in Xodo Sign, this automation takes over:

- Xodo Sign Trigger:

Detects the signed document event. - Formatter by Zapier:

Parses the client’s full name for personalized communication. - Pinch Payments:

Creates or updates the client record in their billing system. - Paths Branching:

Based on client type (Tax Agent, PAYG, or ABN), routes to the correct email sequence. - Gmail Integration:

Automatically sends:- A Business Checklist for Tax Agents,

- A Pre-Approval Email and PAYG-specific email, or

- A Pre-Approval Email and ABN-specific email.

🔄 Flow Snapshot

- Tax Agent: Checklist sent via Gmail.

- PAYG Clients: Pre-approval + PAYG guide.

- ABN Clients: Pre-approval + ABN-specific guidance.

💡 Key Results

- Admin Time Saved: 100+ hours annually.

- Consistency: Every client receives the correct, branded onboarding material.

- Client Experience: Improved trust and professionalism from immediate follow-up.

- Billing Alignment: Synced client data with Pinch Payments.

🧰 Tools Used

- Zapier Multi-Path Automation

- Xodo Sign

- Pinch Payments

- Gmail API

- Formatter by Zapier

✅ Outcome

This automation ensures that the moment a document is completed, the client is welcomed, informed, and ready to move forward — all without a single manual email.

Leave a comment